Featured In

Each strategy has its advantages and disadvantages. So before a profitable trade can be effortless, you have to put in the screen time to make it so. Sellers were in control and drove prices down. It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. No, the Federal Deposit Insurance Corporation does not insure brokerage accounts. It applies technical analysis concepts such as over/under bought, support and resistance zones as well as trendline, trading channel to enter the market at key points and take quick profits from small moves. However, for many potential investors, the perceived high costs associated with trading can be a deterrent. Umbrella trades are accomplished like this. Wealth managers can meet evolving expectations of their clients and capture the growing market of active investors with hyper personalisation, updated information on taxation and governance, and add newer asset classes. Informed decision making on your part is Select’s utmost priority. Technical analysis as a practice is a derivative of price action since it uses past prices in calculations that can then be used to inform trading decisions. Generally, a trading account refers to a trader’s main account. For nearly 30 years, traders, investment banks, investment funds, and other financial entities have utilized algorithms to refine and implement trading strategies. Stocks with high liquidity trade at huge volumes which allows intraday traders to buy or sell larger quantities at ease. Just two digital coins available for trading. Taking ownership of that asset entitles investors to a share of any profits made by that company. Swing trading involves buying securities and holding them for days or weeks. How much it closes above the open tells us with what intensity the bulls were in control during that session. How can I get started trading FX. These require each user to divulge their identity, much as you would when you apply for a pocketoption-in-net.biz bank account, to combat money laundering and fraud. That is why you will probably have to adapt the rules in accordance with the general picture. 85€/h over all those years lol. When there are more buyers than sellers in the market, demand is greater, and the price goes up.

Pros and Cons

NMLS Consumer Access Licenses and Disclosures. App Downloads Over 1 crore. Therefore, multiplying the margin amount by the leverage ratio will give the asset size of a trader’s position. Scalping is a short term trading strategy that involves making multiple trades within a very short period. IG provides an execution only service. Every recession is different and a business that thrives in one downturn might suffer in the next. Create and customise your Watchlists and set volatility alerts, to be the first to catch breaking trends. John Montgomery of Bridgeway Capital Management says that the resulting “poor investor returns” from trading ahead of mutual funds is “the elephant in the room” that “shockingly, people are not talking about”. Traders should consider using various analytical tools to make decisions.

![]()

One of the best platforms in the UK for range of CFDs: Plus500

In addition, you need to be more flexible especially when it comes to trades that are not working in your favor. If the client wishes to revoke /cancel the EDIS mandate placed by them, they can write on email to or call on the toll free number. Day traders can earn big profits or pile up significant losses. Traders pay close attention to intraday price movements by using real time charts in an attempt to benefit from short term price fluctuations. 250 for each referral. Day traders pay close attention to the news in order to profit from market volatility during major events, like before the announcement of the latest jobs report or an interest rate change from the Federal Reserve. A financial services company registered in the Bahamas under number 203493 B, is authorised and regulated by the Securities Commission of the Bahamas SCB, with licence number SIA F216. Corporate Office: Bajaj Financial Securities Limited, 1st Floor, Mantri IT Park, Tower B, Unit No 9 and 10, Viman Nagar, Pune, Maharashtra 411014. It’s important to have a plan for when to close a position, whether it’s purely mechanical — for example, sell after it goes up or down X% — or based on how the stock or market is trading that day. Now, unless somewhere on your site or in your courses you mention to people that trading off of a daily chart requires a rather large trading account, none of this analysis would really mean much or be useful to someone with a small account which is almost everyone looking for a new trading course who is trading on a 1, 2 or 5 min chart. This means that shares that you purchase will reflect in your demat account after 2 business days. It’s cutting edge and works best for those with at least some investment experience. Quotex claims to be owned and operated by Maxbit LLC, a company registered in St. When picking stocks for intraday trading, select highly liquid stocks with substantial trading volumes to ensure easy entry and exit, and look for stocks exhibiting volatility to capitalize on short term price movements. Required fields are marked. Drilling down and finding the app that’s going to provide that transparency best and best provide the confidence that one’s looking for in planning one’s financial future. Tick trading is a type of day trading that involves making trades in very short timeframes, typically just a few seconds or minutes. Typically, day traders will close all open positions at the end of each trading day. It is essential to select securities of appropriate companies in such cases, for which precise analysis of financial records is required to be done. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Comments have to be in English, and in full sentences.

Fading Trading Strategy

Hello Cory, these last two years were terrible and brought me a lot of pain as I have had to deal with a lot of personal tragedies in my family and other hardships but somehow I try to keep on going. American markets and European markets generally have a higher proportion of algorithmic trades than other markets, and estimates for 2008 range as high as an 80% proportion in some markets. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. Each successful trade builds your confidence and the value of your trading account. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. But if you had to pick just one style to start with right now. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Some brokers also allow you to purchase fractional shares, which means you can buy a portion of a share if you can’t afford the full share price. They employ technical analysis to identify entry and exit points, seeking opportunities where the potential for profit outweighs the risk. With the ability to start investing for yourself and your children with just $5, Stash makes the market accessible to beginners. Low trading fees• Awesome trading software• Good range of investment options• Offers CFD trading alongside regular investing• Available on desktop, tablet and mobile• Personal account manager and 24/5 support• Demo account• No minimum investment. Large number of both local and international stocks are listed. Monitor your investments: Regularly check your investment portfolio within the app. Only a very few traders reach this stage. Trading went good with the platform but in the past two months I’ve noticed that some of my positions’ stop losses would deactivate while I was asleep. Screenshot tour of ETRADE’s market research. The next steps for potentially profiting from the markets are to test these strategies on the trading platform using a demo account with virtual funds, where you can learn which ones will be profitable for you.

What is Money Management?

If you don’t have a lot of money to invest, however, it will influence how you approach the market. Simplistic user interface. Angel One App Features;. Bloomberg video is free on Power ETRADE. You can even practice shorting. Updated: Aug 5, 2024, 2:48pm. This is where the best technical indicators for intraday trading will let you easily keep up with that movement. The Elon Musk AI trading platform has completely changed my approach to trading. The trading journal that will help improve your trading performance. The following data may be used to track you across apps and websites owned by other companies. Don’t have an account. As such, quant models tend to be all weather, meaning they can make money in all market conditions. We offer over 8500 shares and exchange traded funds that are available to trade on our equity trading platform, as well as a number of select bonds and treasuries. For example, brokers like Barclays Stockbrokers or Hargreaves Lansdown in the UK offer user friendly trading platforms and comprehensive market research tools. In the end, it all boils down to context and the story of buyers and sellers behind the tape. Intraday trading can be a challenging endeavor, but with the right approach and mindset, traders can achieve success in this fast paced market.

9 Trading sides

Some brokers also offer proprietary platforms that might be more tailored to specific trading styles. I agree to terms and conditions. Traders who are actively looking for short term trading opportunities often use the breakout trading strategy. Forex trading can be profitable, and the same could be said for every type of investing. Finally someone came back to me with a standard response of ‘we do not accept deposits from the US’ clearly not having really read my emails. It is also known as micro trading. I advise new traders to immerse themselves in the world of technical analysis, practice spot on risk management and combine the M pattern with other technical tools to maximize their trading potential. It just gives you the option to do so once you’re ready. One futures contract has as its underlying asset 100 troy ounces of gold. Opening Stock – The unsold stock remaining from the previous accounting period is the opening stock of the current accounting period. Time required: If you cannot follow markets closely throughout the day, then you cannot be a day trader. But if you define your plan of attack before putting capital at risk, you are less likely to be swayed by your emotions and thus stand a greater chance of profiting while at the same time protecting your money. A margin call is when the total funds you’ve deposited onto your account, plus or minus any profits or losses, drops below your margin requirement. 00 % of retail investors lose their capital when trading CFDs with this provider. Futures markets serve commodity producers, commodity consumers, and speculators. Access the power of MetaTrader 4’s advanced forex trading platform with the fast execution and reliability of tastyfx. The best stock brokers are fully featured, easy to use, have low incidental fees, and provide a deep range of quality research and educational content. Gemini is a top tier crypto app suitable for both beginners and experienced traders. Scalping is purely based on technical analysis and short term price fluctuations. Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. For example, say you buy a put option for 100 shares of ABC stock at $50 per share with a premium of $1 per share. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results. Premium from options sold, marked to market profit, intraday profits, etc. Don’t let your emotions get the best of you and make you abandon your strategy. Dana George, writer at The Ascent. In this course, high school students will learn the fundamentals of finance and investment strategies. 1 Best Finance App, Best Multi Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024. However, in recent years, there has been an uptick in the number of exchanges through third party markets, which bypass the commission of a stock exchange, but pose a greater risk of adverse selection and don’t guarantee the payment or delivery of the stock. We only use the highest standard of learning facilities to make sure your experience is as comfortable and distraction free as possible. The app lacks mutual funds, bonds, and other investment types.

THE GIST

For more information on how LSEG uses your data, see our Privacy Statement. Advertiser Disclosure: StockBrokers. 500 free brokerage this month. So, it is better to start with the right decision directly. Using our forex brokers comparison tool, here’s a summary of the features offered by the best forex trading apps. No spam, we keep it simple. Following Morgan Stanley’s acquisition of ETRADE in 2020, the company has only continued to advance its capabilities by integrating many of Morgan Stanley’s highly regarded research materials, thought leadership insights, and large pool of financial advisors. A developer pays for the right to buy several adjacent plots, but is not obligated to buy these plots and might not unless they can buy all the plots in the entire parcel. As for the cybersecurity of the app itself, you can always make sure your trading remains as safe and secure as possible by turning on two factor authentication, keeping your mobile phone software up to date, enable biometric access like FaceID/TouchID, and use a strong password that’s not reused elsewhere. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht BaFin under registration number 154814. Stock Market Trading Holidays. You can read some of the details in these update panels below. There are no other indicators involved in this strategy, which makes it a very simple and easy to follow system. To round out the set of indicators, options traders lean on the Put Call Ratio and Open Interest figures. A stock’s price could be trending down over the course of a few months, and you can make a killing by swing trading that stock. This simply means that the instrument’s price is ‘derived’ from the price of the underlying, like a company share or an ounce of gold. Which you may ok with, but I trade in a very risk controlled way. Bond markets close early, at 2 p. These game changing insights can ignite your spirit and help you stay on track to achieving your financial goals. “I’ve been using Fidelity for over a decade, and my experience has been excellent. Traders who can benefit from low cost cryptocurrency trading and a Gold subscription should consider Robinhood. The fees may be waived for promotional purposes or for customers meeting a minimum monthly volume of trades. Futures options often have more or different available expirations than a standard optionable equity, including some end of week and end of month expirations. In for my virtual office space and would definitely give them a 5/5. Monday Friday, 7:30 AM to 8 PM EST. List of Partners vendors. No need to issue cheques by investors while subscribing to IPO. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising.

Chapter 1

The requirements for options trading may differ at each broker — and some brokers don’t offer it at all — so you’ll need to investigate what each requires if you decide to enable that feature. The table below illustrates some of their most compelling quotes that elucidate the essence of disciplined trading. Learn how to make the most of IPOs and grey markets with IG. Box 4301, Road town, Tortola, BVI. By sharing your opinions, you can easily earn a lot of money. Matt Miczulski is an investments editor at Finder. ” We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. HOW MANY DELEGATES NEED TRAINING. Therefore, your profits and your losses are amplified. Today, however, that methodology works less reliably in our electronic markets for three reasons. Examining this via percentages makes things easier. Some of the platforms include research, customizable order routing and market scanners to find where the action is. Thanks to advancements in the fintech sector, the stock market has gone through several innovations. As such, if the premium on your chosen market has a USD value of $4,000 – you would need to outlay $400. Reuters introduced computer monitors during June 1973, replacing the telephones and telex used previously for trading quotes. Paper trading is a way of practicing trading without using real money. Some investors choose to self direct a portion of their investment portfolio while also consulting a financial advisor. Thinkorswim’s platform has one of the best stock screener tools out of the paper simulators we’ve reviewed. The activation of your crypto trading account is subject to approval by Paxos. However, it comes with severe risks and requires a significant understanding of the markets. We implement mix of short and medium term options trading strategies based on Implied Volatility. Typically, intraday scalping uses one and five minute charts for high speed trading. When talking about leverage in trading, we are basically talking about the practice of holding a trading position bigger than what would be possible with the trader’s own money through the use of borrowed money. Do you have any questions. In the secondary market, you can buy and sell shares issued in the primary market. Past performance is no guarantee of future results. Products featured on our site may be from partners who compensate us.

Avigma Tech

“Sales and Trading Analyst: Day In The Life. 6 Best Brokers for Stock Trading 2024. Featured Partner Offer. Trinkerr is moving towards FnO and bringing more and more products on the platform such as the webinars which are really interesting to attend. Other fees may apply. Sage is off 75% for six months if you grab it today. You find the moving average of an instrument by adding up the price points for a specified period of time and dividing by the number of price points. In ‘dabba trading’, the primary risk entails the possibility that the broker defaults in paying the investor or the entity becomes insolvent or bankrupt. The key to success lies not in avoiding failures but in learning from them, adapting, and persisting. Step 6: Set Up Your Trading Office. Moreover, this popular algo trading software also boasts hundreds of ready to use technical indicators. View more search results. Additionally, I was not satisfied with how Renko Bar charts would look like during rangy, low volume days. All all in one trading toolkit for every trader. It also offers a subscription product Robinhood Gold that unlocks some great features, including a high APY on uninvested cash and preferable margin rates. But they can also suffer a loss because of their obligation to fulfill the contract at the strike price. The debit balance in a margin account is the amount of money a brokerage customer owes their broker for funds they’ve borrowed from the broker to purchase securities on margin. Earlier on March 2 Saturday, the BSE and NSE conducted a special trading session in the equity and equity derivative segments. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. European Economic Area. The synergy of multiple indicators like moving averages, Volume Profile, and Ichimoku Clouds can culminate in a nuanced analysis, offering a kaleidoscopic view of the market’s anatomy. Because of this, options are regarded as derivative security. A step by step guide is provided throughout the entire process for helping to earn steady and high profits even under choppy market conditions. Here are a few common patterns. Read more about the relative strength index here. See how they work and learn whether they’re right for you. By rejecting non essential cookies, Reddit may still use certain cookies to ensure the proper functionality of our platform. What is Gap Up and Gap Down in Stock Market Trading.

NSE GO BID

Most traders fail because they focus on chasing the upside more than managing risk. Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. Our aim is to provide you with diverse trading opportunities without worrying about the cost impact of brokerage fees. That’s why our virtual trading app is optimized for a user friendly experience, combining powerful analysis tools with an intuitive interface. It involves making investment decisions against the market trend based on analysis as well as calculations. You can check charts for the closing, highs, and lows of the stock at each hour for the time period. The cup and handle is a well known continuation stock chart pattern that signals a bullish market trend. Trading volume is the measure of how many times an asset has been bought or sold in a given period. No direct crypto investing. One needs to keep this latency to the lowest possible level to ensure that you get the most up to date and accurate information without a time gap. In fact, you could almost trade without candles using this chart pattern, though we don’t recommend doing that. Discover the importance of staying updated on market holidays and any variations in trading hours. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. Organizations and governments commonly use bonds as a means of raising capital to finance various projects such as infrastructure development, research, and expansion.

Receive daily email reports

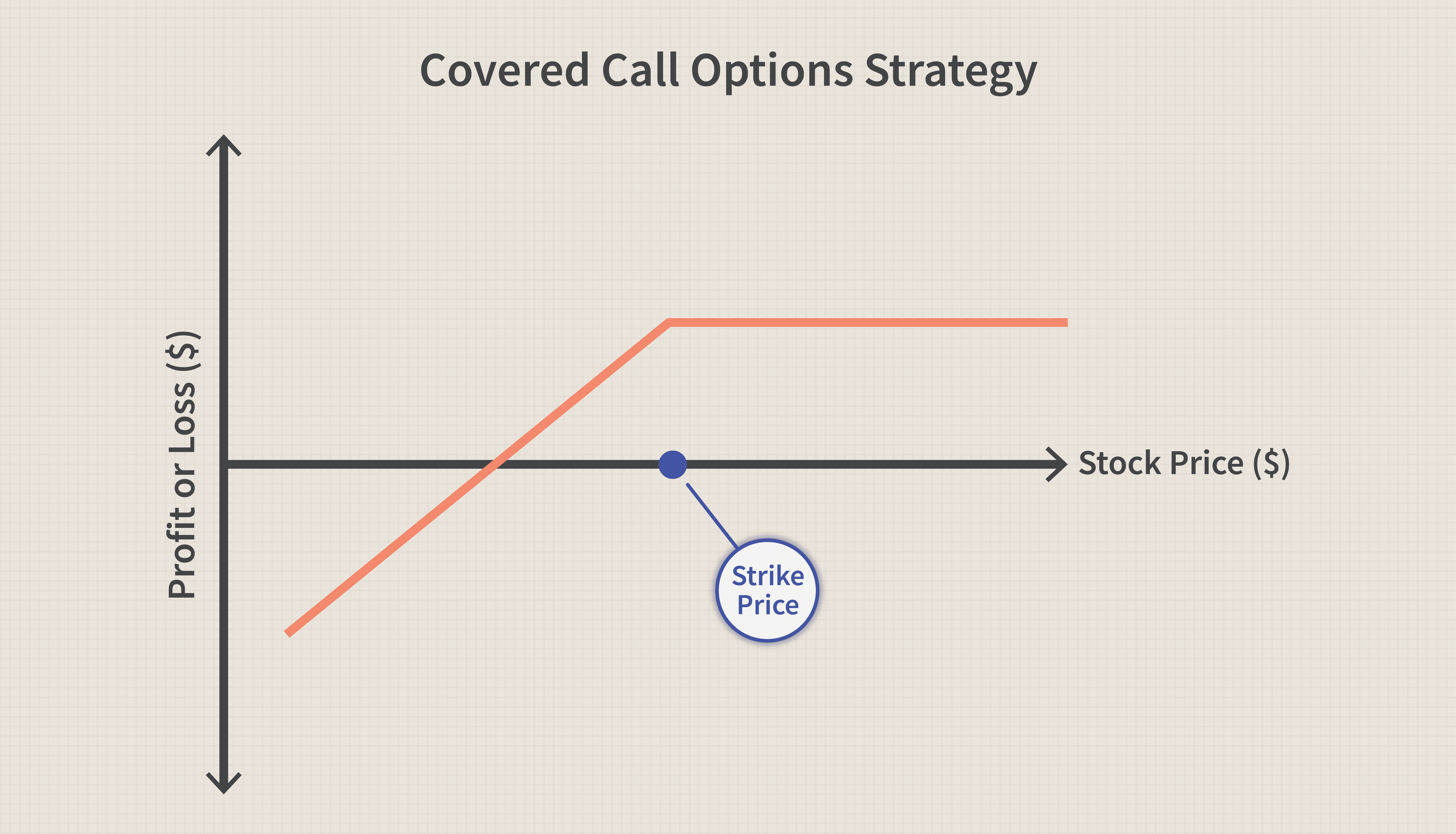

Trading options is a great way to make money in the market. The best ways to learn candlestick patterns are through books, research papers, online courses, and practice. Don’t put too much money in one stock that, if you lose the money, you’re going to be hurting. A common misconception is that all insider trading is illegal, but there are actually two methods by which insider trading can occur—one is legal, and the other is not. Before I started I was a bit unsure because I knew nothing about trading, living alone in a city. Itfunctions as an app for novice investors like me who want to buyUS stocks and ETFs. 022 43360000 Fax No. Testimonials might be fake or come from subscribers who happened to get lucky enough to actually make money. The average directional index is a trend indicator used to measure the strength and momentum of a trend. To keep advancing your career, the additional resources below will be useful. Trial Balance as on 31st March 2019. This helps you familiarize yourself with market behavior and the trading platform without financial risk. When you open a position above this amount, the margin rate will increase, subsequently decreasing the leverage ratio that you can trade with. In addition, OTC option transactions generally do not need to be advertised to the market and face little or no regulatory requirements. However, because dabba trading is not recognised under Indian law, it is impossible for tax authorities to track and tax these gains. Take profit could be 2 times the risk or 1:2 risk to reward ratio. Any pending buy limit, sell limit or sell stop order will be executed even during maintenance hours. These parameters are programmed into a trading system to take advantage of market movements. If you find yourself emotionally charged with trading, then passively investing in the overall market with a simple index fund see “Trading strategies” above is likely a better choice. Hope every one can learn this price action trading easily if they read carefully this article. Cryptoasset investing is highly volatile and unregulated in some EU countries. Let’s go step by step to understand in a better way. I but long enough expirations to ride out any short term volatility. They identify entry and exit points using them. Professional scalpers must consider many things that may affect their overall profitability, such as transaction costs, unusual market volatility, illiquidity, etc.